💧Liquidity

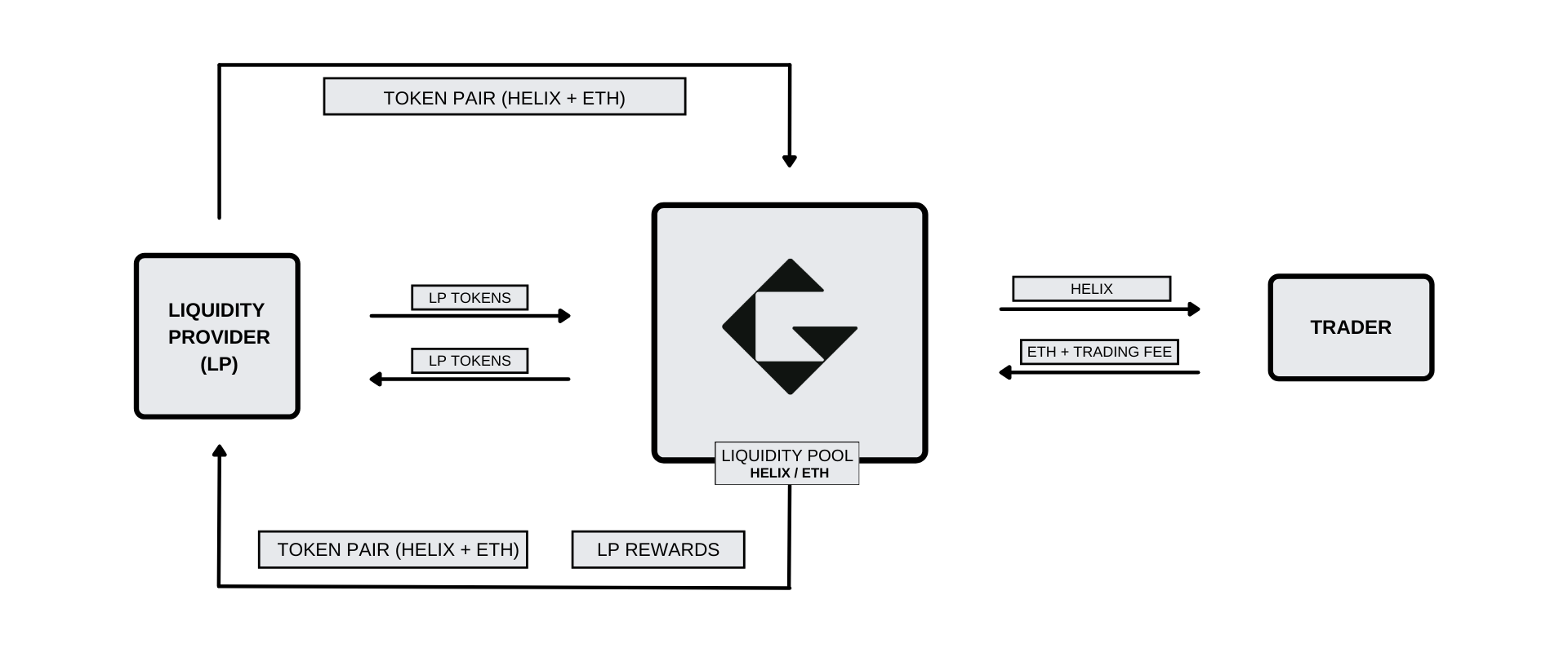

Liquidity pools are another of the core components of Helix (and other AMM's), being the means in which trading is undertaken on the platform.

By providing a pair of tokens users can create and fund liquidity pools in order to facilitate trade and receive rewards for doing so. These rewards are distributed proportionally to all LP's (liquidity providers), depending on the number of tokens each has staked in the pool.

Being algorithmically priced by the smart contracts governing them (using the constant product formula, x*y=k), liquidity pools essentially allow users of Helix to trade directly, and automatically, with the pooled funds held within, removing many of the inefficiencies of centralized exchanges, and enabling the decentralized, non-custodial environment.

Liquidity pools play an essential role on Helix, allowing participants of the protocol to enjoy fully permission-less and decentralized trading!

LP Tokens

After depositing funds into one of the liquidity pools on Helix, Liquidity providers are issued LP tokens denoting their total share of that particular pool. These tokens must be returned in order to redeem any funds placed in the pool, but can be used in the meantime to gain even further yield on crypto deposits.

Although it is necessary to deposit assets as a pair when providing liquidity, only one LP token is dispensed, for example:

If depositing into the HELIX and ETH liquidity pool, HELIX-ETH LP tokens would be issued.

LP Rewards

All Liquidity providers are entitled to a share of the trading fees generated from that particular pool, which is taken from the 0.1% fee applied to each swap. The trading fee is distributed in its entirety to the platforms liquidity providers.

LP rewards accrue in real-time, and can be redeemed at any point by withdrawing liquidity from the pool.

As an added benefit, LP tokens received from supplying liquidity can then be deposited into the Helix farms, in order to harvest additional yield!

Risks Of Providing Liquidity

The farms and pools on Helix have been audited, ensuring that the main risk of providing liquidity on the platform remains that of impermanent loss, whereby staked tokens are exposed to fluctuations in price, compared to at the time of deposit. The greater the movement in price, the greater the potential loss, meaning that If the impermanent loss exceeds the rewards earned by the user, this is considered a negative return when compared to simply holding the tokens in a wallet.

The full audit for Helix can be found here.

Last updated