🏛️Yield Swaps

Yield swaps is a catch-all term for the novel derivative markets being deployed on Helix.Finance, which essentially provide users of the platform the opportunity to fortify their position, either through speculation or hedging, and allow for a more efficient re-deployment of liquidity between Ethereum-based protocols.

Included within Yield swaps on Helix.Finance are LP swaps, which involve trading the underlying assets (LP tokens) from any ERC-20 platform, and yield swaps, which allow users to speculate on future returns.

Yield swaps are a new form of derivative auction system which resemble the interest rate swaps used in traditional financial markets

Benefits Of Introducing Yield Swap Markets To DeFi

Higher levels of capital efficiency

Increased protection against volatile (or essentially, lower) yields

More efficient portfolio management, with predetermined cash flow and higher levels of predictability

Gas efficient re-deployment of funds

What Are Yield Swaps

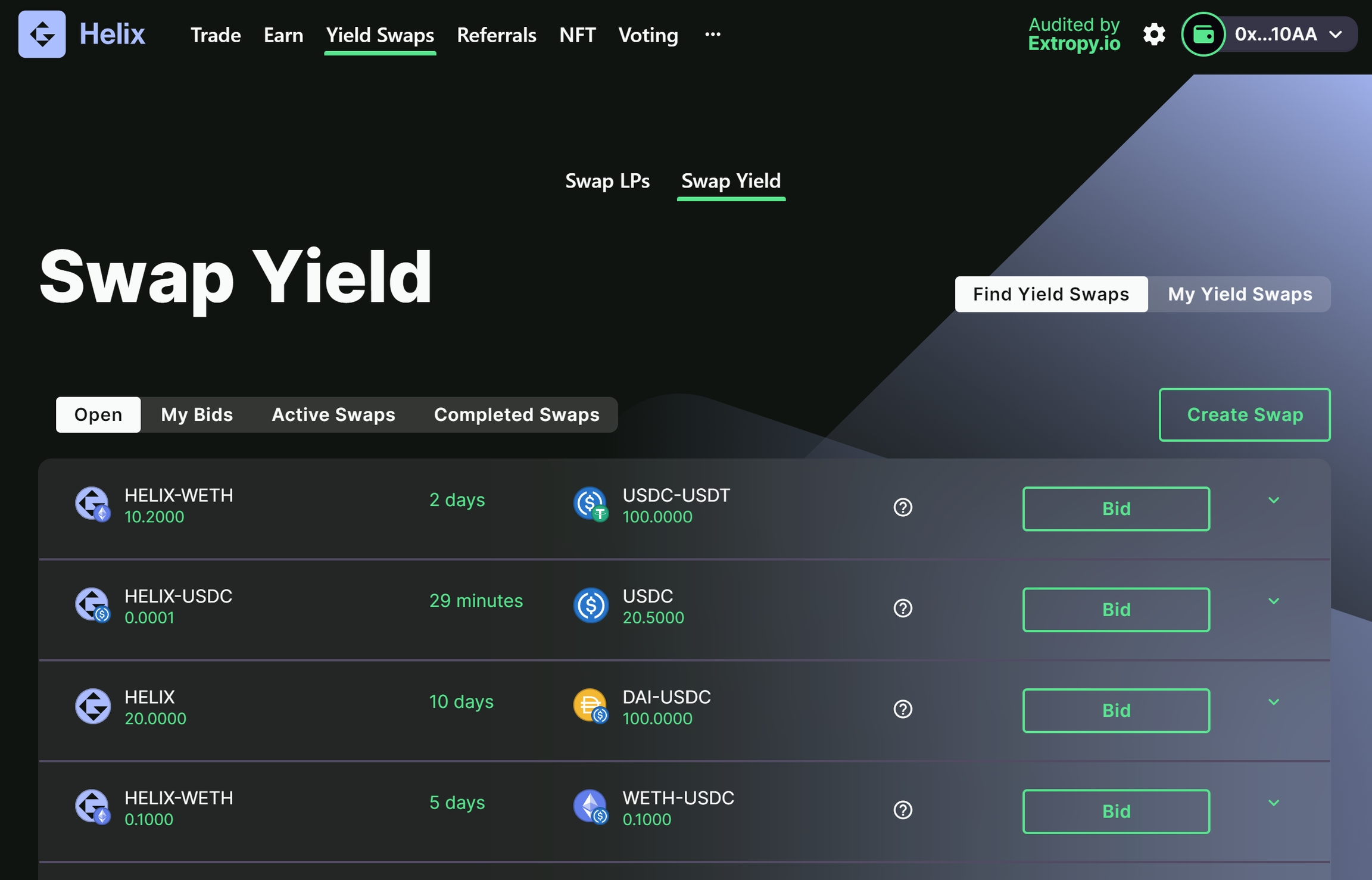

Helix currently offers two different types of yield swaps, with various possible markets within each category. LP Swaps - Include LP tokens from any ERC-20 protocol LP tokens <---> Other LP tokens LP tokens <---> HELIX LP tokens <---> DAI/USDC Yield Swaps - Are swaps of the yield generated over a given period of time Locked LP tokens <---> Other Locked LP tokens Locked LP tokens <---> HELIX (paid immediately) Locked LP tokens <---> DAI/USDC (paid immediately)

In a Yield swap, the variable is the requested asset, and not the offered LP tokens/Yield, which is fixed

Negotiation Process

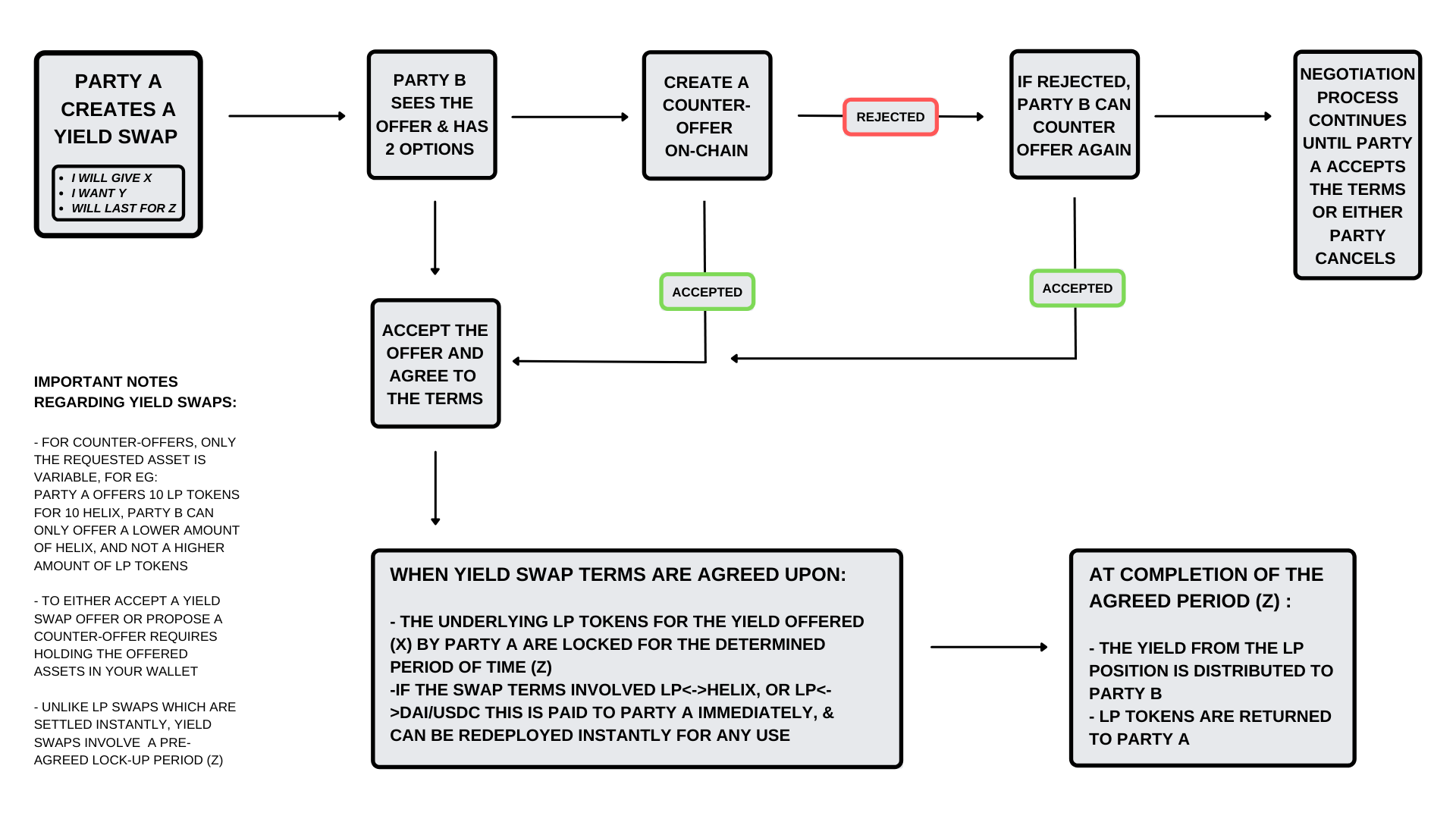

In order to process a swap, an agreement must be reached between two parties, this could involve either: - Acceptance of the terms - Negotiated counter-offer The negotiation process is carried out on-chain, and would go as follows; -Party A creates the swap order (Will give X, Want Y, This will last for Z)

Party B can then choose one of two options: -Accept the offer, to do so requires having the requested tokens in a wallet -Create a counteroffer, which also requires having the requested tokens in-wallet. In the case of a counter-offer Party A could either choose to accept, decline, or just ignore. This process would continue until either Party A accepts, or one/or both party cancels.

The process can be viewed in the basic image below

The APR Problem In DeFi, & The Need For Yield Swaps

Due to the volatility of the space and the limited liquidity available to the many protocols, APRs can change quite regularly, and while this could be considered a negative for yield chasers, it also presents opportunities when combined with swaps, and the ability to lock in a fixed yield for a period of time.

Advantages & Utility Of Yield Swaps In DeFi

Provides speculators and yield bulls with more ways to generate wealth, and new profit opportunities

Allows yield bears to de-risk, and hedge against possible APR drops

Enables the immediate redeployment of funds, increasing personal capital efficiency

Provides higher stability and a safe haven within the volatile crypto markets

On-boards TradFi users with familiar financial instruments

Creates new levels of interoperability between ERC-20 protocols, allowing for the fast, cheap, and easy movement of LP positions

Balances a financial ecosystem, connecting a bull with a bear

Yield Swap Fee

There is a fee applied to both parties in a yield swap, which is broken down as follows:

Yield Swap Fees: 0.45% maker, 0.55% taker

Yield Swap Fee Allocation:

Admin Fees: 67% of the fee collected from each swap

Geobot Staking Pool: 33% of the fee collected from each swap

Last updated