🔄Exchange

As an automated market maker (AMM), Helix allows for the fast, automated, and efficient trading of ERC-20 tokens in a decentralized and permission-less environment.

Users of the protocol can swap tokens directly with the liquidity held in pools, rather than awaiting a trading counterpart, as is the case in a centralized exchange.

Decentralized exchanges provide a non-custodial environment, allowing users to retain funds in their own wallet, without the need for a trusted third-party.

How Does The Helix AMM Function

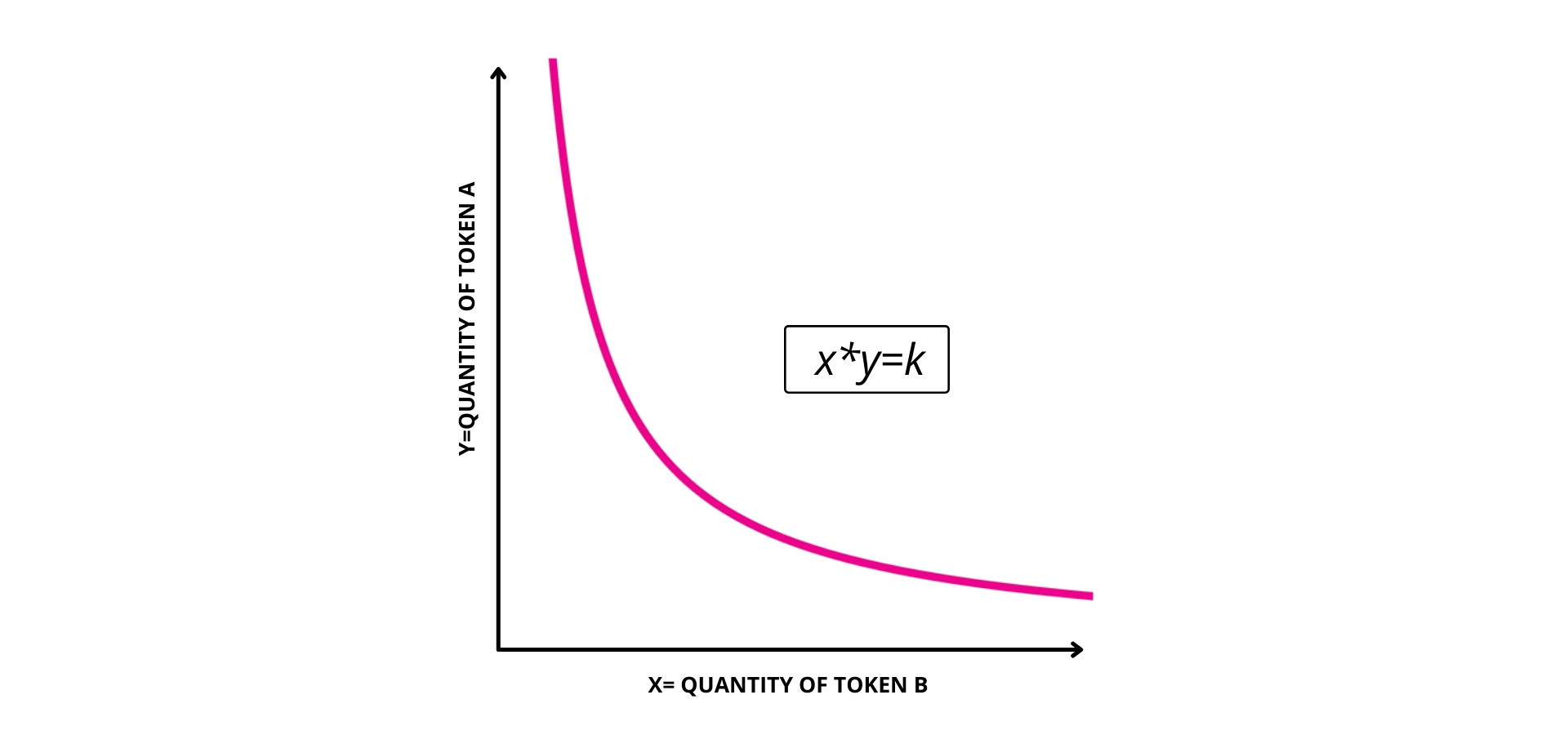

Helix exchange offers a simple method of swapping ERC-20 tokens via automated liquidity pools. The rate of the swap, and therefore the price of the token, is algorithmically determined by the AMM with the constant product formula (x*y=k), this ensures that there are always tokens for users to trade, defines and maintains the price, and removes the need for an intermediary.

In the constant product formula x*y=k, x and y are the reserves of two tokens (A & B). In order to withdraw an amount of token A, the user must first deposit a proportional amount of token B, in order to maintain the constant k

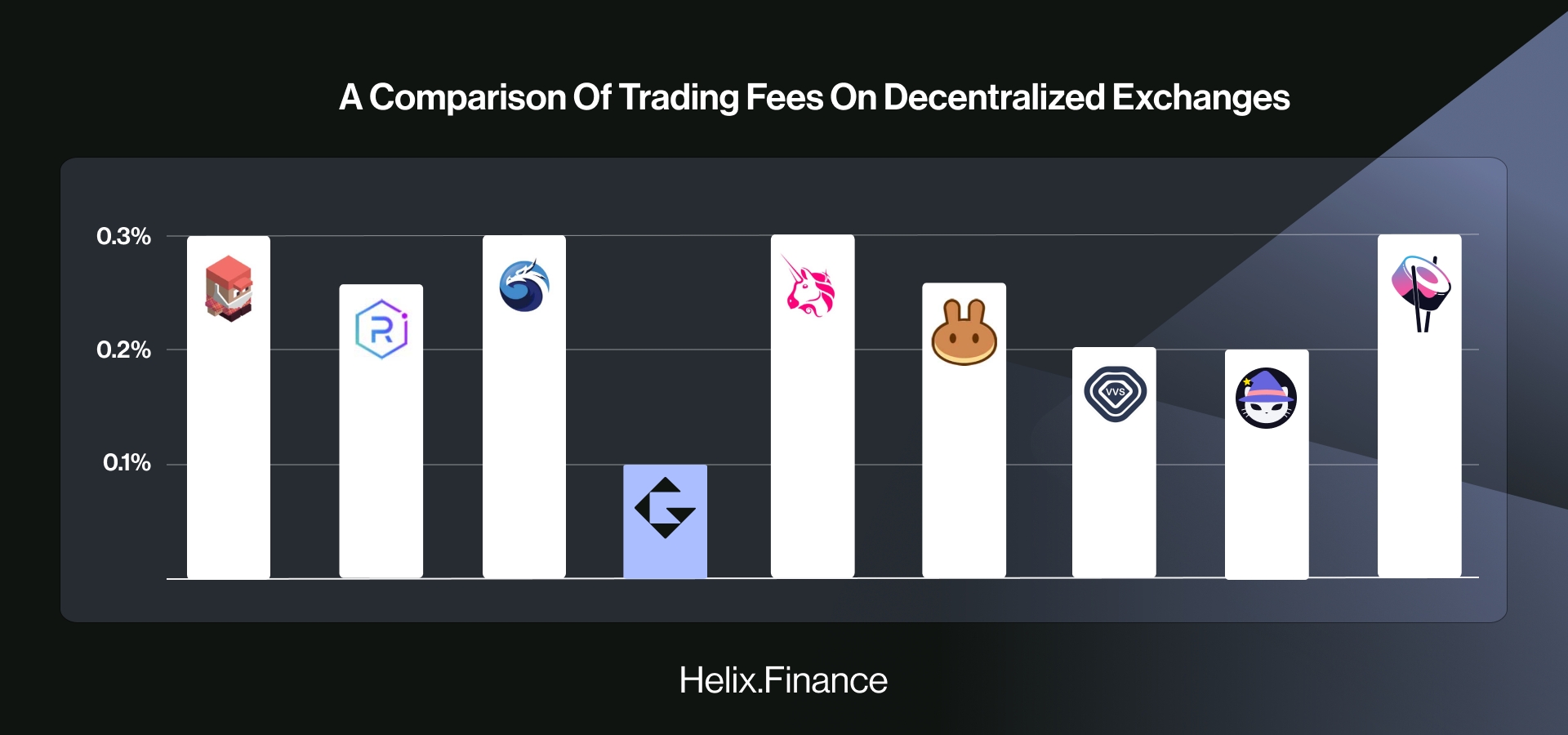

Low Trading Fees

As standard, each time a trade is made on Helix a small fee of 0.1% is applied, which is allocated as follows:

Fee Applied To Each Trade: 0.1% - Distributed in its entirety between the pools liquidity providers.

Last updated